- Home

- Bookkeeping Articles

- Sound Bookkeeping Principles for Petaluma Businesses

Sound Bookkeeping Principles For Petaluma Businesses

Managing Finances and Cash Flow

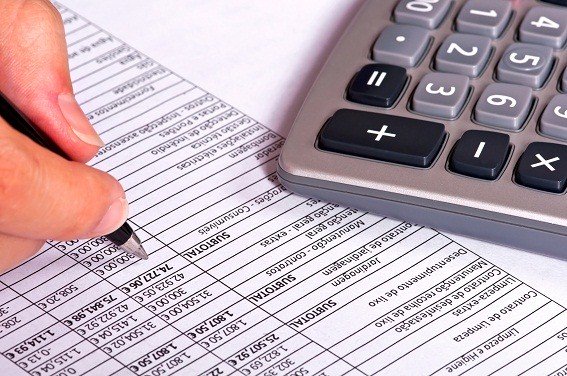

Sound Bookkeeping Principles for Petaluma Businesses - In order to manage your company’s finances, you need to practice sound bookkeeping principles. Petaluma businesses should follow these tips.

Are you one of the few business owners that review

your businesses financial statements every month? Research indicates that the

majority of small business owners do not practice sound bookkeeping principles

as they do not realize the value of understanding their financial statements.

However, practicing sound bookkeeping principles is

an essential element of running a business. If you are reluctant to record your

financial transactions, we urge you to take the time to understand the

importance and implement a system that is easy to follow.

Sound Bookkeeping Principles for Petaluma Businesses

Recording financial transactions can be a very tedious process for active businesses. However, there are a number of reasons that bookkeeping is extremely important:

- You keep track of your bills so that you don’t face late fees or order cancellations.

- You remember to send invoices for goods and services that you have delivered.

- You keep better track of outstanding liabilities, which keeps you from getting too deeply in debt.

- You will have a better idea of your available capital, which will allow you to allocate it more prudently.

Practicing sound bookkeeping principles is important to remain financially solvent and track expenditures. However, many businesses have difficulty finding the time needed to implement it properly. They will need to develop a system that allows them to keep track of their finances as efficiently as possible.

Developing a Bookkeeping System

You may run into some challenges with sound bookkeeping principles for Petaluma businesses. Petaluma businesses need to find a way to keep track of their transactions efficiently to avoid any challenges they may face. Consider the following tips to develop a bookkeeping system.

Learn the Basics

You don’t need to be a rocket scientist to learn the basics of bookkeeping. Petaluma companies can figure them out pretty easily after taking a course or reading a book on the topic. This blog also provides plenty of material to help you get started.

There are a number of subtle rules that you will need to learn, but they all revolve around the Fundamental Rule of Accounting. After leaning this rule and the way debits and credits work, you will be able to start implementing a bookkeeping strategy.

Organize Your Records

It is imperative that you keep track of all financial records. Make sure that the following documents are carefully organized:

- Invoices from suppliers to manage accounts payable

- Records of work completed

- Banking and credit card statements

- Receipts for any payments

- Accurate records for tax liabilities

It is a good idea to retain both physical and electronic records of all financial transactions. You will need them to cross-reference your financial records for discrepancies, so make sure that you save them even if you believe the information is redundant.

Invest in Bookkeeping Software

QuickBooks and other accounting software can streamline the bookkeeping process. You can purchase a standard version of QuickBooks for about $250. It is well worth the investment, because it will save considerable amounts of time. You may also want to read these tips from Business News Daily to use the product more efficiently.

Essential Bookkeeping Principles

Sound bookkeeping principles are essential for maintaining accurate financial records and making informed business decisions. Here are some key principles to follow:

- Accuracy and Attention to Detail: Bookkeeping requires precision and attention to detail. It is crucial to accurately record all financial transactions, including income, expenses, assets, and liabilities. Mistakes or omissions can lead to discrepancies in financial statements, tax filings, and business decisions. Regularly reconcile accounts to ensure accuracy and identify any discrepancies promptly.

- Consistency and Uniformity: Consistency is vital in bookkeeping. Establish clear and standardized procedures for recording transactions, categorizing expenses, and organizing financial documents. Consistent practices ensure that financial information is reliable, comparable, and easily understandable.

- Timeliness: Bookkeeping should be done in a timely manner. Record transactions promptly to maintain an up-to-date and accurate financial picture of the business. Delayed bookkeeping can lead to errors, missed deductions, and challenges in monitoring cash flow and financial health.

- Proper Documentation: Maintain proper documentation for all financial transactions. Keep receipts, invoices, bank statements, and other relevant documents organized and easily accessible. Proper documentation provides evidence of transactions, supports financial records, and facilitates accurate reporting and compliance with tax regulations.

- Segregation of Duties: Implement a system of checks and balances by segregating bookkeeping duties. Divide responsibilities among multiple individuals to reduce the risk of fraud or errors. For example, separate the tasks of recording transactions, reconciling accounts, and approving payments. This segregation enhances accountability and reduces the likelihood of misappropriation or manipulation of financial records.

- Financial Controls: Establish internal controls to safeguard assets, prevent fraud, and ensure accuracy in bookkeeping. Implement procedures such as regular bank reconciliations, periodic audits, and review of financial statements. These controls help identify and rectify errors or irregularities, providing greater confidence in the integrity of financial data.

- Use of Technology: Embrace bookkeeping software and digital tools to streamline processes, improve accuracy, and enhance efficiency. Accounting software can automate tasks, track expenses, generate reports, and simplify financial management. It also facilitates easy integration with other business systems, improving data accuracy and reducing manual errors.

By adhering to these sound bookkeeping principles, businesses can maintain accurate and reliable financial records, monitor financial performance effectively, make informed decisions, and ensure compliance with regulatory requirements. Proper bookkeeping is a fundamental aspect of sound financial management and supports the long-term success of any organization.

Contact Us if You Need Help

Tracking your finances is very straightforward once you understand the basics. However, many businesses can’t commit the time needed to learn or practice sound bookkeeping principles. For Petaluma and other business owners in the North Bay area, please do not hesitate to contact us if you are interested in our bookkeeping services. We look forward to hearing from you.

Please subscribe to my monthly newsletter, Bookkeeping Basics E-zine. It tells you every month about the new information that I have added, including some great tips and advice from myself and other Bookkeeping Basics readers.

Like Bookkeeping-Basics.net?

- Home

- Bookkeeping Articles

- Sound Bookkeeping Principles for Petaluma Businesses

New! Comments

Have your say about what you just read! Leave me a comment in the box below.