Bookkeeping General Journal Question

by Teng

(Melbourne)

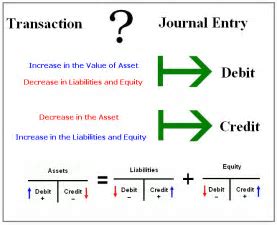

General Journal Entry

In the opening balance of general journal, the balance bank account of say $30,000, should that be in debit or credit in my accounting and why?

Capital Stock Journal Entry

by sana ali

(islamabad)

Stock Sale Journal Entry

What is the entry of sold capital stock to owners?

Computer Journal Entry

by Denisee

(Dublin)

Computer Journal Entry

How would I record the journal entry for purchase of a computer on credit?

Corporate Journal Entries

by Marissa

(Los Angeles)

Corporate Journal Entries

How would a journal entry look for this circumstance?

The president of ABC Corp. takes out 1,000.00 from the corporate checking account for personal use.

DR

CR

Expense Journal Entry

by Md. Bilal Uddin

(London)

Expense Journal Entry

Please show the advance journal entry for expense as an adjustment.

General Journal & NCG

by Lindy

(Geelong Vic Australia)

General Journal Entry in QB

Hello. I'm attempting to make a general journal entry in QuickBooks. I've created a CityLink account as an "other current liability account." When I input the following general journal details:

CityLink Account: $8.32 (including tax)

Motor Vehicle: $8.32 (including tax)

and use "NCG" for each line in the journal, it appears twice in my tax payable account, both as billed and paid. How can I correctly set this up in the General Journal Area? Regards, Lindy :)

Journal Entry Corrections

by VAL

(UK)

Suspense JE Adjustments

I need to make the journal entries to correct these errors:

Trial balance failed to agree and the difference of £680 is recorded in the credit side of a Suspense acc. On investigation the following errors are discovered:

1. A purchase inv for £157 had been posted to J W Day & Sons in error. The goods have been bought from Days Supplies.

2. The Sales Day Book has been overcast by £220.

3. A cheque payment for repairs to the office building of £41 had been entered in the accounts as £14.

4. A payment by cheque of £50 to A Biggs has been debited in the cash book and credited to A Biggs Acc.

5. The purchase of a motor vehicle costing £5600 has been entered correctly into the bank account but debited to the motor vehicles account as £6500.

6. A credit sale of £180 had not been entered into the accounts.

I need details of a suspense acc showing the original opening balance and the entries that must be made to clear the account. Many thanks.

Journal Entry Recording

by Sue

(Chesapeake VA)

Recording Daily Payouts

When recording daily pay outs in the journal entry, what account would you credit against these types of expenses?

Journal Entry For Repairs

by deepti

(sydney)

Repairs Journal Entry

What's the journal entries for these two transactions:

1. Received an invoice for $75 for repairs done to shop equipment.

2. Organized a loan from the bank for $15,000 to be paid back over 3 years.

Journal Entry Question

Prepaid Expense Journal Entry

On October 1, your company, which operates on a calendar year and uses the accrual accounting method, enters into a $15,000 painting contract.

You make an advance payment of $5,000 and record it as a "Painting Expense." If by December 31, management informs you that only 20% of the work has been completed, how would you adjust the accounts to reflect the appropriate expense?

Journalize Truck Business Purchase

Truck Purchase Journal Entry

Croteau invested $45000 in moving business.

The business purchased a $35000 TRUCK FROM Darcy Moors by paying $10.000 difference will be paid at a later date. How do you journalize this?

Journalizing Transactions

by Angel

(Kingsland)

Journalizing Transactions

Which of the following statements best describes journalizing transactions?

A. Journalizing occurs after posting to the ledger.

B. Journalizing must be done daily.

C. Journalizing is the process where events of business are recorded in the journal.

D. Journalizing can’t be completed until the ledger accounts have been opened.

Liability Journal Entry

Liability Adjustment

The liability for land and building is on the balance sheet and it has been paid but they did not adjust the liability account, so the Balance Sheet shows a large account of debt that has been paid. I know to debit the liability but what do you credit. This is a non-profit

Product Certificate Redemption Journal Entry

by Sue P

(Lancaster, PA)

Product Certificate Journal Entry

I am self-employed and work on commission as a distributor. Booking that commission is straight forward. My question is: They also issue product certificates (PCs) that we can redeem for products. We only pay shipping. The PCs have no cash value in reality.

If not used by their expiration date, they are unusable. However, if I redeem them, I will need to reflect that in my business's books, but I am unsure how. For example, I use PCs to purchase a $500 item. I have no outlay of cash except for the $30 shipping fee. How would I book this?

Return and Exchange Journal Entry

Return and Exchange Journal Entry

What journal entries should be made for the following transaction:

A customer purchases an equipment for $2000 and pays in full with cash. Subsequently, the customer returns the equipment and exchanges it for another equipment valued at $1000.

However, the store wants to impose a restocking fee of 20% of the original equipment's cost ($2000).

Please provide the appropriate journal entries for this transaction.

Sales Tax Payable Journal Entry

Sales Tax Payable JE

Not so much my forte. I need to move x amount from a sales tax payable account to the penalties account.

X was debited from sales tax payable, and same x was credited to accounts payable. How do I move everything to a penalty? Help.

Statutory Deduction Journal Entries

by Lucy Msoro

(Tanzania)

Statutory Deductions

What are the journal entries to be recorded in the books when recognizing statutory deductions accruals and when making payments of statutory deductions?

Truck Accident Journal Entries

by rajan kalia

(gaborone, botswana)

Asset Write-Off

When a truck is purchased on a loan for $255,600 and is involved in an accident before the loan is fully paid off, resulting in a write-off, the insurance company pays the bank an amount of $153,567.

The bank then returns $43,860 to the company. How do you pass these journal entries?

What Journals To Use

Office Supplies Journal Entry

When I get an invoice for office supplies what journals do I put them in?

Like Bookkeeping-Basics.net?

Thank you for visiting ..

Before you go, please fill out the form below to start getting valuable money saving tips for you and your business now!