- Home

- Chart of Accounts

- Chart of Accounts Income Tax Refund

Chart of Accounts Debit Account

by Henk

(Canada)

When creating an account within the Chart of Accounts, is there a way to have one account subtract the amount from another account?

Example:

You create a subgroup account called Capital Gain, and another subgroup account called Capital Loss.

Now you want a subgroup total account called Net Gain. How would the account Capital Loss be set up so the amount in this account is subtracted from Capital Gain?

Comments for Chart of Accounts Debit Account

|

||

|

||

Chart of Accounts Auto Question

by Maarten Verwey

(Apple Valley Ca USA)

Is the Department of Motor Vehicles (DMV) expense a fee or automobile expense?

Comments for Chart of Accounts Auto Question

|

||

|

||

|

||

Chart of Accounts Cash vs Equity

by Steve H

(Anchorage, Alaska)

For a sole proprietorship, do I need to set up a cash account/capitol account or is owner's equity basically the same thing? They both equity accounts correct?

IE: My quickbooks program doesn't have a cash account or capitol account listed in the chart of accounts (I can add one if needed). The chart of accounts does have owners equity listed.

Thanks, Steve

Comments for Chart of Accounts Cash vs Equity

|

||

|

||

Chart of Accounts Fee Allocation

Where would I allocate a federally required fee to publish the company's tariffs? It seems like it would be COGS, subheading Legal Fees since it is a fixed cost and to distinguish it from Office Expenses - Legal Fees for variable legal fees not directly related to projects.

I don't think it falls under Advertising since it's a federally required fee and fixed cost?

Comments for Chart of Accounts Fee Allocation

|

||

|

||

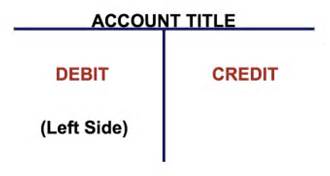

Chart of Accounts Learning T Accounts

I'm a student and I have a bookkeeping question I have to do a T account the question is If I paid 400 in rent Do I do 2 T accounts 1 for expenses and I'm not sure where the other goes on the chart of accounts.

Comments for Chart of Accounts Learning T Accounts

|

||

|

||

Chart of Accounts Loss on Disposal

by Morris Yawane

(Port Moresby, Papua New Giunea)

What I want to know is where in the chart of accounts would "loss on disposal" be found?

Comments for Chart of Accounts Loss on Disposal

|

||

|

||

|

||

Chart of Accounts Miscellaneous

by Madi

(London)

When a parking permit is paid out from mt petty cash account is this a miscellaneous expense? Also, does council tax go into a General rates account?

Comments for Chart of Accounts Miscellaneous

|

||

|

||

Chart of Accounts Income Tax Refund

by Shari

( Nampa, ID)

Which account should an income tax refund go to on the Chart of Accounts?

Comments for Chart of Accounts Income Tax Refund

|

||

|

||

Please subscribe to my monthly newsletter, Bookkeeping Basics E-zine. It tells you every month about the new information that I have added, including some great tips and advice from myself and other Bookkeeping Basics readers.

Like Bookkeeping-Basics.net?

- Home

- Chart of Accounts

- Chart of Accounts Income Tax Refund