- Home

- Bookkeeping 101

- Accounts Receivable

Accounts Receivable

Keeping Track Of Money Owed To You

Accounts receivable is the term that bookkeepers and accountants use to refer to the outstanding money that is owed to you for sales that you have already made that haven't been paid for yet.

The account is called A/R for short. There usually is only one single account on the chart of accounts to track all of the outstanding invoices even though the word "accounts" is plural.

This is a bookkeeping 101 account that should be added to your chart of accounts by the first time you write an invoice. The account will be used to track the money that is owed to your business.

When you obtain the bookkeeping services of a professional bookkeeper they will make sure this account is setup for you.

Bookkeeping 101 E-Book

This Bookkeeping 101 EBook is a useful tool for business owners, bookkeepers, accountants and anyone responsible for household personal finances.

You can receive the complete Bookkeeping 101 accounting series in a 23 page E-Book for $4.97 along with all sorts of other accounting, business and financial goodies.

Accounts Receivable Account

When you receive a payment from a customer, or when you write an invoice, you should enter the transaction in the register for your A/R account.

This account is listed in your chart of accounts as "Accounts Receivable." But if you really need to use more than one of this type of account in your business, then you can add additional A/R accounts to the chart of accounts as well.

Accounts Receivable refers to the money owed to a business by its customers or clients for the goods or services provided on credit. It represents the outstanding balances that are due to the company from its customers within a specified payment period.

Accounts receivable plays a vital role in a company's financial health and cash flow management. Here are some key aspects highlighting its importance:

- Revenue Generation: Accounts receivable represents the sales made by the company, reflecting its primary source of revenue. It demonstrates the value of goods or services delivered to customers, creating an expectation of payment.

- Working Capital Management: Accounts receivable is a significant component of a company's working capital. It represents the funds that can be utilized to meet day-to-day operational expenses, invest in growth opportunities, and pay off the company's liabilities.

- Cash Flow Optimization: Timely collection of accounts receivable is crucial for maintaining a healthy cash flow. By efficiently managing and collecting receivables, businesses can ensure a steady inflow of cash to meet financial obligations, manage expenses, and pursue growth initiatives.

- Credit Sales and Customer Relationships: Offering credit sales to customers can be an effective strategy to attract and retain clients. It allows customers to access goods or services without immediate payment, facilitating increased sales and fostering long-term relationships. Effective accounts receivable management ensures that customers fulfill their payment obligations in a timely manner, maintaining trust and minimizing potential disputes.

- Financial Planning and Analysis: Accounts receivable data provides valuable insights for financial planning and analysis. By monitoring and analyzing receivables, businesses can assess their credit policies, identify patterns of late payments or delinquencies, and make informed decisions regarding credit terms, collections strategies, and customer creditworthiness.

- Cash Flow Forecasting: Accurate accounts receivable data enables businesses to forecast cash flow accurately. By understanding the timing of receivable collections, companies can anticipate cash inflows and plan for any potential cash shortfalls or surpluses.

- Financial Reporting: Accounts receivable is a crucial component of financial reporting, appearing on the balance sheet as an asset. It provides stakeholders, including investors, creditors, and management, with insights into the company's sales performance, creditworthiness of customers, and overall financial health.

Effective management of accounts receivable involves establishing clear credit policies, monitoring customer payments, issuing timely and accurate invoices, implementing collection strategies, and maintaining strong customer relationships. By optimizing accounts receivable processes, businesses can improve cash flow, enhance financial stability, and drive growth.

In conclusion, accounts receivable is a fundamental aspect of business operations, representing revenue, cash flow, and customer relationships. Proactive management of accounts receivable is essential for maintaining a healthy financial position, maximizing cash flow, and ensuring the overall success and sustainability of a business.

Entering An Open Balance For A Customer

For each customer that you have, you will need to enter the amount owed to you on your start date. If you do not know the opening balance, you can choose a different start date starting from when you do know the opening balance.

Or you can figure out the opening balance by reconstructing what your customers owe you today by subtracting any payments they made between then and now, and adding any additional billings between then and now.

You can also ask your accountant for the year-to-date balances for your accounts.

When you enter the opening balance for your customers, you're building the A/R opening balance.

From Your Start Date Up To Today's Date

When you enter the following types of transactions using the standard sales forms (checks, bills, and invoices) you are ensuring that your A/R accounts (and accounts payable and income and expense accounts) are up-to-date and accurate:

Bill payments

Bills from vendors

Credits from vendors

Deposits Ledgers

Sales tax payments

Invoices and sales receipts with sales tax, if appropriate

Customer returns

Payments received from customers

If you have additional accounts receivable questions, you can find out more on our A/R questions and answers page.

Accounts Receivable Register

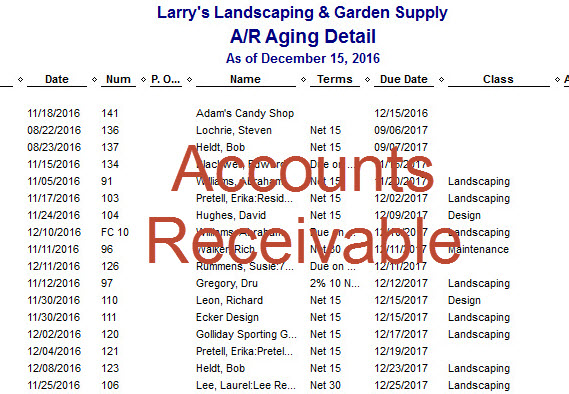

The A/R register will list all of the payments from customers, credit memos, invoices, and customer discounts that you have entered related to each of your individual customers.

New statement charges can typically be entered directly into the register. A statement charge will appear as one item, instead of the multiple items that are shown on the invoice. You cannot enter any other transactions directly into the register.

Following is a sample of what an Accounts Receivable register might look like:

More Bookkeeping 101

- Accounts Payable

- Accounts Receivable

- Balance Sheet

- Bank Reconciliation

- Chart of Accounts

- Profit and Loss Statement

Please subscribe to my monthly newsletter, Bookkeeping Basics E-zine. It tells you every month about the new information that I have added, including some great tips and advice from myself and other Bookkeeping Basics readers.

Like Bookkeeping-Basics.net?

- Home

- Bookkeeping 101

- Accounts Receivable

New! Comments

Have your say about what you just read! Leave me a comment in the box below.