- Home

- Bookkeeping Supplies

- Accounts Payable Spreadsheet

Accounts Payable Spreadsheet

Efficient Streamlined A/P Solution

The Accounts Payable Spreadsheet offers a practical and efficient solution for managing your A/P processes. It is designed to streamline the tracking and organization of invoices, payments, and outstanding balances, providing you with a clear overview of your money owed.

With the Bookkeeping Supplies Excel format, you can easily enter and categorize vendor invoices, track payment due dates, and record payment information. It also includes built-in formulas for automatic calculations, such as aging reports and total outstanding balances.

Accounts Payable Spreadsheet

By utilizing this user-friendly tool, you can improve accuracy, reduce manual errors, and enhance the efficiency of your accounts payable management. It is customizable to fit your specific business needs, allowing you to tailor it to your preferred format and data requirements.

Take control of your A/P processes and gain better visibility into your financial obligations with this valuable tool. Simplify your accounting and bookkeeping tasks and ensure timely payments while maintaining accurate records. Download the A/P Spreadsheet today and streamline your accounts payable operations.

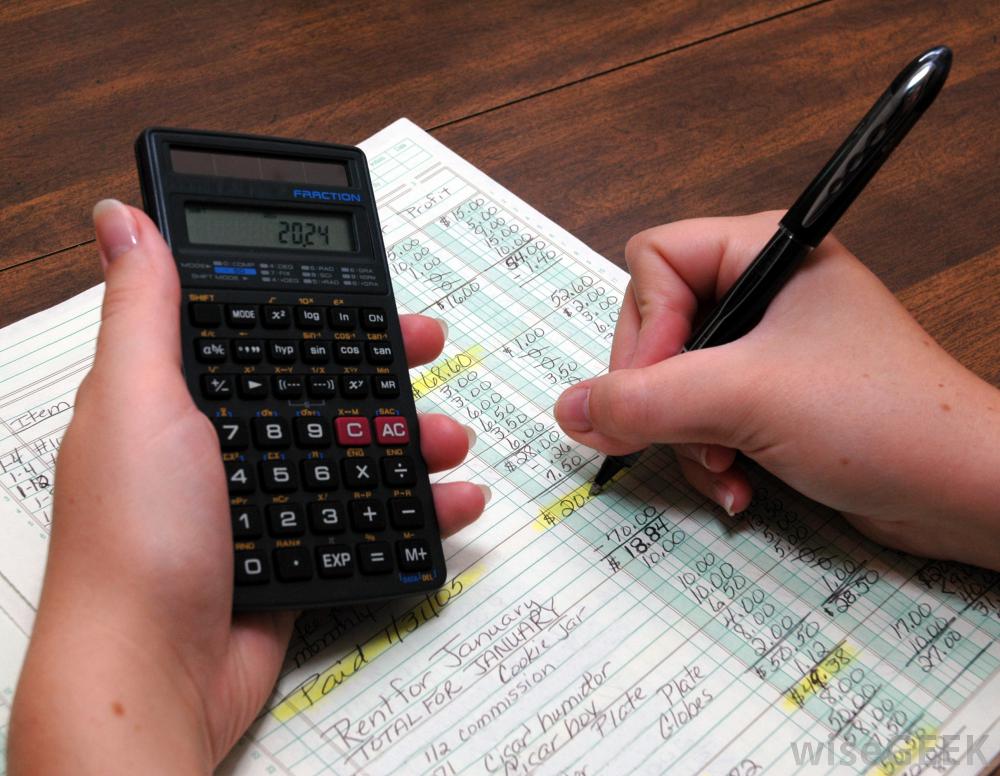

As a business owner, knowing some accounting methods and procedures are important. Even if you solicit the bookkeeping services of a bookkeeper or accountant, understanding what they do and how they calculate your bottom line should be a priority. When keeping track of your financials, there are a few basic spreadsheets you should be familiar with: Accounts Payable, Accounts Receivable and Balance Sheet.

The Accounts Payable spreadsheet is one of the most important functions of your business. It documents your lines of credit, outstanding bills and your inventory. This spreadsheet is an easy, quick-to-read assessment of when you need to pay your bills and any accounts that may be in jeopardy of becoming past due or are already past due and need your attention.

How can I create an accounts payable spreadsheet?

Creating a user-friendly and efficient accounts payable spreadsheet is a straightforward process, even if you are not using specialized bookkeeping software. By leveraging familiar tools such as Microsoft Excel, you can design a customized solution that meets your specific needs.

Utilizing Excel's versatile features and functions, you can set up columns for vendor names, invoice numbers, payment due dates, and amounts owed. With built-in formulas, you can automate calculations for aging reports, total payables, and outstanding balances. Additionally, Excel allows you to apply formatting options for better visualization and organization of your data.

While dedicated bookkeeping software may offer more advanced features, using Excel provides a cost-effective and accessible solution for businesses of all sizes. With its widespread familiarity and extensive online resources, you can find templates and tutorials to guide you.

Take advantage of the flexibility and familiarity of Microsoft Excel to create a reliable and efficient accounts payable sheet that aligns with your business requirements. Whether you opt for a simple layout or incorporate more complex functionalities, Excel empowers you to effectively manage your payables while leveraging a tool you are already familiar with.

Steps of Creating an Accounts Payable Spreadsheet

These directions are for using a program such as Microsoft Excel or an OpenOffice platform.

1.You want to begin by opening your document and creating a header. You can name it whatever is most useful, but “Accounts Payable – Month/Year” would be very helpful once they start accumulating.

2.Once you do this, save your document. You may want to create a folder labeled Accounts Payable and then save the document by month and year.

3.The column headings in your accounts payable spreadsheet are important. They delineate your categories. You should have the following headings at a minimum. If you need additional headings for your own purposes, you can add them as you go:

4. Format all date categories to reflect a numeric and date format. You can do this by locating the Number section on the ribbon. You will see a drop down box that says “General.” There are five visible icons located after the dropdown. Select the “Number Format” key to specify your numeric preferences. Then, click the dropdown box and select “Short Date” to select your preferred date format.

5. Once this is complete, use the Number section on the ribbon to click the $ icon to select your currency format for the rows that require monetary calculations.

6. Your calculations should reflect accurate numbers. For those past due accounts, you should be entering your amount paid minus the amount due numbers.

7. Once all your calculations and formatting is completed, you can format your document as a table. You do this by selecting the “Format as Table” icon, which will give you a diverse selection to choose from. Once you have selected which one you like, the choice will be applied to your document.

Once you have the Accounts Payable Spreadsheet in place, you will gain valuable insights into your financial position. By tracking and analyzing your payables, you can identify areas for improvement and assess your cash flow accurately. This information can also serve as an indicator of whether you may benefit from professional bookkeeping services.

Maintaining accurate and up-to-date records is crucial for the long-term success of your business. Proactively managing your accounts payable helps establish strong relationships with vendors and enhances your reputation as a reliable and trustworthy company.

If you have any questions or need further assistance, our team is here to support you. Feel free to contact me for any clarifications or guidance you may require.

Accounts Payable Articles

- Accounts Payable Recording Outstanding Bills

- Accounts Payable and the ACA in Santa Rosa

- Accounts Payable and the Self Employment Tax

- Accounts Payable Journal Entries

- Accounts Payable Journal Entries for IRS Audit

- Accounts Payable Petaluma

- Accounts Payable Santa Rosa

- Accounts Payable Affect Cash Flow

- Accounts Payable In Santa Rosa

- Accounts Payable JE's for Growing Businesses

- Accounts Payable Spreadsheet

- Auditing Accounts Payable

- Bookkeeping Services and Accounts Payable

- Calculating Accounts Payable

- Accounts Payable Journal Entry

- Ideal Accounts Payable Turnover

- Improve Accounts Payable Turnover

- Accounts Payable and Minimum Wage Increases

- Streamlining Accounts Payable

Please subscribe to my monthly newsletter, Bookkeeping Basics E-zine. It tells you every month about the new information that I have added, including some great tips and advice from myself and other Bookkeeping Basics readers.

Like Bookkeeping-Basics.net?

- Home

- Bookkeeping Supplies

- Accounts Payable Spreadsheet

New! Comments

Have your say about what you just read! Leave me a comment in the box below.