- Home

- Chart of Accounts

- Intercompany Chart of Accounts

Chart of Accounts Nominal Codes

by Chris

(Wakefield)

What nominal ledger code should I book small tools bought in a mechanic garage please?

Comments for Chart of Accounts Nominal Codes

|

||

|

||

Chart of Accounts Number List

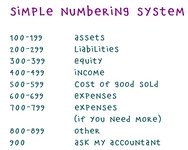

I was given this question...

List the chart of account numbers in beside the type of account.

______Assets

______Liabilities

______Owners Equity

______Revenue

______Cost of goods sold

_______Expenses

Can you please help me with the answer to how to number the Chart of Accounts?

Comments for Chart of Accounts Number List

|

||

|

||

Chart of Accounts Personal Loans

by Pete King

(Ontario, Canada)

If I give my friend some money on a regular basis to pay back a loan and they deposit that into their personal account, do they have to declare that as income?

Comments for Chart of Accounts Personal Loans

|

||

|

||

Chart of Accounts Refundable Overcharge

by Dave Black

(London, England)

In a small non-profit making set-up, in the year 08_09 I charged a client for £300.00. Neither I nor my client had noticed this at the time.

I now find, preparing my annual accounts, that the amount charged should have been £250.00 (an overcharge of £50.00).

I do not want to show this as Income & Expense profit for 08_09, but would rather credit the client towards a future payment – keeping the ‘refund’ at asset level.

I have never met with this type of ‘negative number’ problem before. How do I do this in an accrual double-entry accounts system, and account for this on the chart of accounts and balance sheet?

Chart of Accounts Transfers Between Checking and Savings

I've transferred from my main account to my savings account as an owners draw but now I transfer back to the main account. How is this deligated? To what account?

Hi,

Thanks for your question. Your initial transfer should have posted as follows:

CREDIT Main Account

DEBIT Savings Account

Therefore, the transfer back would simply reverse the original entry as follows:

DEBIT Main Account

CREDIT Savings Account

Intercompany Chart of Accounts

Company #1 gives a check to Company #2 and Company #2 then sends check out to rental company.

The same people own both company #1 and #2. How should I show the check deposited in company #2 on the chart of accounts?

Comments for Intercompany Chart of Accounts

|

||

|

||

|

||

|

||

Please subscribe to my monthly newsletter, Bookkeeping Basics E-zine. It tells you every month about the new information that I have added, including some great tips and advice from myself and other Bookkeeping Basics readers.

Like Bookkeeping-Basics.net?

- Home

- Chart of Accounts

- Intercompany Chart of Accounts